The Central America and Mexico Youth Fund (CAMY Fund) is a program of the Seattle International Foundation (SIF) that supports youth leaders and activists in the creation and implementation of projects that ensure the full and equitable enjoyment of youth rights.

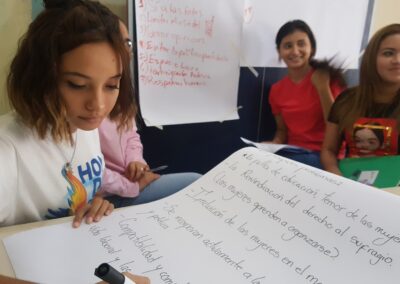

Youth in the region lead the forefront of social movements and develop creative approaches to achieve social, systemic and sustainable change in their communities. They seek to challenge and transform existing power structures and draw on artivism, new media, and innovative social and political advocacy strategies to amplify their voices and stories and facilitate the advancement of their agendas.

Created in 2014, SIF’s CAMY Fund provides flexible funding, support and technical and political accompaniment to youth-led initiatives, collectives and organizations in Central America and Mexico. Its objective is to strengthen youth social movements in favor of human, social, gender and racial, and sexual and reproductive rights. With a perspective of collective care and territorial defense, the fund promotes the well-being of the partner organizations with which it works.

Focus

We focus on prioritizing the needs of the partner organizations we work with and on creating inclusive and respectful spaces for people who live in the region and work from their own vision.

The CAMY Fund brings together partners and allies to exchange learning and experiences and build peer-to-peer networks. It complements its commitment to youth through research with inclusive and participatory approaches.

Over the past nine years, the CAMY Fund has established itself as a leader and the only fund of its kind that finances youth specifically in Central America and Mexico. In addition to expanding its geographic reach and resources, it provides accompaniment to youth-led organizations, collectives and movements working in three key areas:

- Sexual and reproductive health and rights and the defense of the rights of children, adolescents, youth and gender-dissident persons in the area of sexual and reproductive health.

- Social justice and support for youth organizations and movements committed to human rights, equality and non-discrimination.

- Collective care as a strategy for action and sustainability through the prioritization of a holistic health approach, with emphasis on mental health, psychosocial support and holistic safety.

Publications

Our research allows us to understand the characteristics and needs of youth social movements from their perspectives, so that we can meet their needs, address gaps in support, and share this knowledge with other donors who fund movements in the region.

Past events

August 18, 2022

Webinar

Disruptive Youth Movements Launch

Disruptive Youth Movements (MJD) is a regional and collaborative investigation on how youth in Mexico, Guatemala, El Salvador, Honduras, Costa Rica, Panama and Colombia organize themselves and the possibilities of working with them through philanthropy.

The project was carried out from 2020 to 2021 and was led by the Seattle International Foundation´s CAMY Fund in partnership with Diakonia, Global Fund for Children and FRIDA Fund.

Join the research presentation and the conversation about the findings, experiences, lessons learned and proposals derived from this unique project in the region.

Thursday, August 18, 2022

12:00 pm Central America / 1:00 pm Mexico and Colombia

The event will be held in Spanish. There will be simultaneous interpretation in English.

Blog

Team

The CAMY Fund has a team of people with experience and commitment to the youth of Central America and Mexico. Get to know them: